When you pick up a generic pill at the pharmacy, you expect it to work just like the brand-name version. That’s the whole point. But what if the drug isn’t just a simple tablet? What if it’s an inhaler that delivers medicine deep into your lungs, a cream that needs to penetrate your skin, or a liquid injected slowly into your bloodstream over days? These are complex generic formulations-and proving they work the same as the original isn’t just harder. It’s often like solving a puzzle with half the pieces missing.

What Makes a Generic Drug "Complex"?

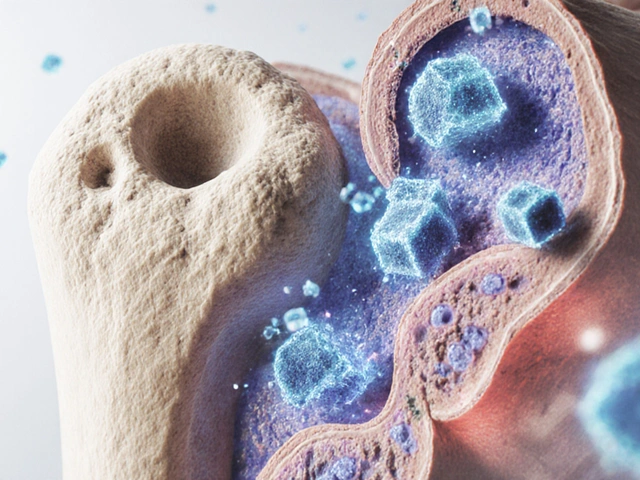

Not all generics are created equal. Simple generics-like a generic version of ibuprofen or metformin-are straightforward. They contain one active ingredient, dissolve predictably, and get absorbed into the bloodstream the same way every time. Bioequivalence is easy to prove: measure blood levels over time, compare the test drug to the brand, and if the numbers fall within 80%-125%, you’re approved. But complex generics? They’re different. The FDA defines them as products where the way the drug is delivered or how it behaves in the body makes traditional testing methods useless. These include:- Liposomal injections (tiny fat bubbles that carry drugs to specific cells)

- Inhalers for asthma or COPD that spray medicine into the lungs

- Topical creams, gels, or ointments meant to act on the skin, not enter the blood

- Transdermal patches that slowly release drugs through the skin

- Complex eye drops or ear drops with special suspensions

- Drug-device combos like auto-injectors or nebulizers

The Bioequivalence Problem: You Can’t Measure What You Can’t See

For a simple pill, bioequivalence means showing that the same amount of drug enters your bloodstream at the same rate. But for an inhaler? The goal isn’t to get the drug into your blood-it’s to get it into your lungs. And you can’t stick a needle into someone’s lungs to measure how much medicine landed there. Same with a steroid cream for eczema. The drug is supposed to stay in the top layers of the skin. Measuring blood levels tells you nothing. It might show no absorption at all-even if the cream is working perfectly. So how do you prove it’s equivalent? The answer? You don’t. Not the old way. Regulators are forced to rely on indirect methods: testing how the drug particles are sized, how the cream spreads on skin, how the inhaler sprays, how long it takes to release the drug. These are called in vitro tests-done in labs, not in people. But here’s the catch: if the test doesn’t match what actually happens in the body, you’re just guessing. That’s why the FDA says demonstrating bioequivalence for these products is “not always straightforward and efficient.” It’s not just difficult. It’s often impossible with current tools.The Reverse-Engineering Nightmare

Imagine trying to copy a secret recipe. You taste the dish. You notice it’s creamy, slightly sweet, with a hint of spice. But you don’t know the ingredients. You don’t know the cooking time. You don’t know if the chef used butter or olive oil, salt or soy sauce. You try 50 versions. None taste right. That’s what generic manufacturers face with complex drugs. They don’t get the original formula. They don’t get the manufacturing specs. All they get is the final product on the shelf. So they have to reverse-engineer it-breaking it down, analyzing every particle, every excipient, every step of the process. This is called “de-formulation.” And it’s expensive. A complex generic can take 18 to 24 months longer to develop than a simple one. Costs can be 2.5 to 3 times higher. And failure rates? Over 70% at the bioequivalence stage. Even small changes-like switching the type of preservative, or changing the mixing speed during manufacturing-can alter how the drug behaves. A liposome might break apart. A cream might not absorb the same way. A spray might not reach the right part of the lung. These aren’t theoretical risks. They’ve caused real-world approval failures.

Regulatory Maze: One Country’s Rule Is Another’s Roadblock

Even if a company cracks the science, they still have to navigate a patchwork of global rules. The FDA, the European Medicines Agency (EMA), and Health Canada don’t always agree on what counts as proof. For example: the FDA might accept an in vitro test showing that an inhaler’s particle size matches the brand. The EMA might demand a clinical study in patients showing the same lung deposition. One company ends up running two separate trials-just to get the same drug approved in two markets. That’s not efficiency. That’s waste. A 2020 industry survey found that 89% of generic manufacturers said bioequivalence testing methods were their biggest challenge. Another 76% pointed to stability issues. And 68% struggled just to characterize what was even in the product. It’s not that regulators are being stubborn. It’s that the science hasn’t caught up. Until we have better tools, regulators are forced to be cautious. One bad approval could mean patients don’t get the right dose. And in complex drugs, even a 10% difference can mean treatment failure.New Tools on the Horizon

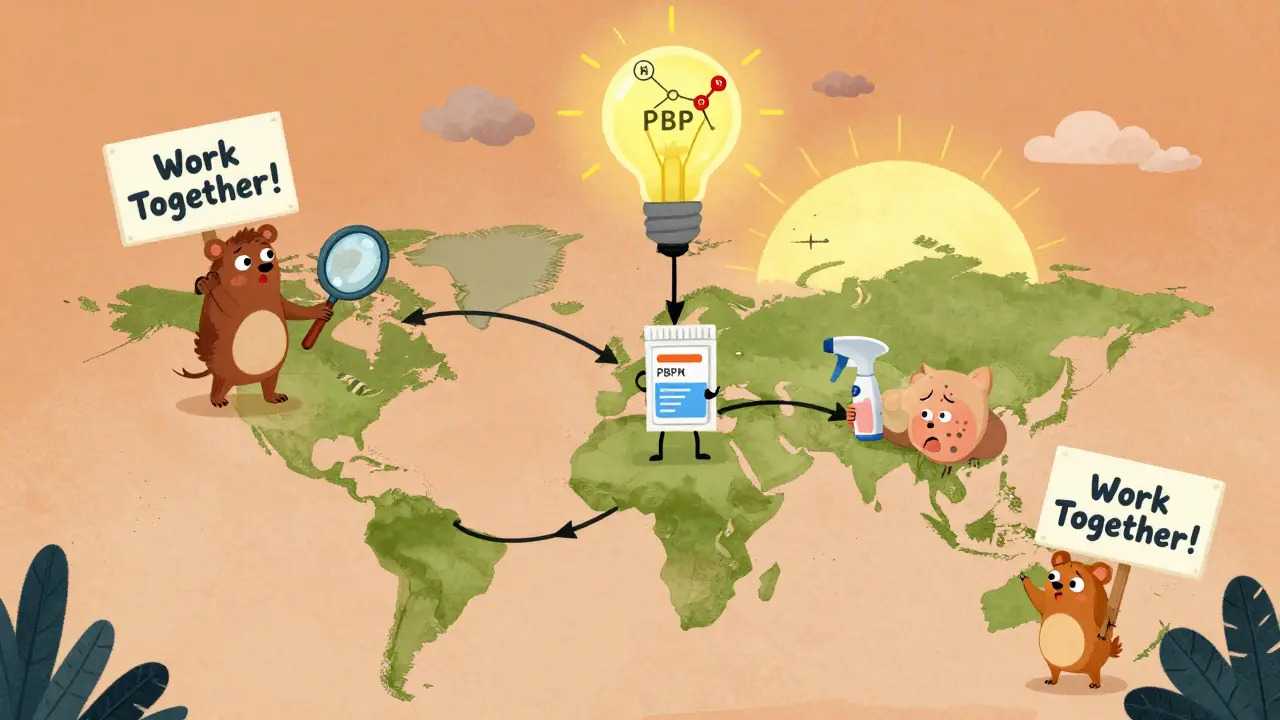

There’s hope. The FDA is investing in new ways to measure what used to be invisible. One breakthrough is physiologically-based pharmacokinetic (PBPK) modeling. Instead of waiting for human trials, scientists build computer models that simulate how a drug moves through the body based on its physical properties. For some complex products, this could cut bioequivalence testing needs by 40-60%. Other tools are emerging too:- Imaging tech that shows how deep a cream penetrates skin

- Artificial lungs that mimic how particles deposit in airways

- Advanced sensors that track drug release from patches in real time

Why This Matters for Patients

You might think, “So what? If it’s hard, just let the brand keep its monopoly.” But here’s the reality: complex drugs are often the only treatment for serious conditions-asthma, psoriasis, cancer, chronic pain. And they’re expensive. Some cost over $10,000 a year. In the U.S., about 90% of prescriptions are filled with generics. But for complex drugs? Only 10-15% have generic versions. That’s not because no one wants to make them. It’s because the science is too hard, the costs too high, and the risks too great. The market for complex generics is worth $120 billion in the U.S. alone. And it’s growing fast-projected to hit $45 billion by 2028. But without better tools and clearer rules, that growth will stall. Patients deserve affordable access to these life-changing drugs. But affordability can’t come at the cost of safety. The challenge isn’t to make copies faster. It’s to make sure those copies work the same way.What’s Next?

The future of complex generics depends on three things:- Standardized methods-agreed-upon tests for particle size, spray patterns, skin penetration, etc.

- Regulatory alignment-the FDA, EMA, and others working together so one test works everywhere

- Industry collaboration-manufacturers sharing data, not just competing

It’s not about copying. It’s about understanding. And that takes time, money, and patience. But for millions of people who rely on these drugs, it’s worth it.

Why can't we just use blood tests to prove bioequivalence for complex generics?

For drugs that act locally-like inhalers, creams, or eye drops-the goal isn’t to get the drug into the bloodstream. The drug is meant to stay in the lungs, skin, or eyes. Measuring blood levels doesn’t tell you if the right amount reached the right place. That’s why regulators now rely on indirect tests, like particle size analysis or skin penetration models, instead of traditional pharmacokinetic studies.

What percentage of complex generics actually get approved?

Only about 10-15% of complex generic applications get approved, compared to over 80% for traditional small-molecule generics. The main reasons are difficulty proving bioequivalence, unstable formulations, and inconsistent testing methods across regulatory agencies.

How long does it take to develop a complex generic compared to a regular one?

Developing a complex generic takes 18 to 24 months longer than a traditional generic. Total development time can stretch to 5-7 years, with costs 2.5 to 3 times higher. Failure rates at the bioequivalence stage exceed 70%.

Why do manufacturers struggle with stability in complex formulations?

Complex formulations often contain multiple ingredients that interact unpredictably. Factors like temperature, humidity, and light can trigger degradation-like particles clumping, creams separating, or drugs breaking down. Even minor changes in manufacturing can alter the product’s performance. Stability testing becomes a moving target because the product’s behavior is sensitive to tiny variations.

Are there any new technologies helping with bioequivalence testing?

Yes. Advances like physiologically-based pharmacokinetic (PBPK) modeling, imaging techniques for skin and lung deposition, and automated in vitro testing systems are helping. PBPK models can predict how a drug behaves in the body without human trials, reducing testing needs by 40-60% for some products. The FDA has also published 15 new guidance documents since 2022 to support these new methods.

10 Comments

i swear i took a generic inhaler last year and it felt like someone threw a rock in my lungs instead of mist... why is this so hard to fix?? 🤦♀️

The FDA's approach is archaic they still rely on in vitro assays for complex formulations when we have PBPK modeling and microdosing now which can predict in vivo behavior with 90 accuracy if you actually know what you're doing which most regulators dont

This issue is not merely technical; it reflects a global disparity in regulatory harmonization. In India, where generic access is vital, we often receive products that are pharmacologically identical yet fail bioequivalence criteria due to differing regional guidelines. A unified framework is not a luxury-it is an ethical imperative.

70% failure rate? That's not science. That's gambling with patient lives. And no one's talking about how manufacturers cut corners on excipients to save costs

The progress in PBPK modeling is genuinely promising. It's encouraging to see regulators adapting. Patience and collaboration will yield better outcomes than pressure or frustration.

THE BIG PHARMA CONSPIRACY IS REAL 😱 they don't want generics because they make BILLIONS from these expensive inhalers and creams... they're hiding the real formula on purpose!!! 💀🧪

I used to think generics were just cheaper copies but now I get it-these complex drugs are like rebuilding a symphony from one note. You can’t just copy the sheet music, you gotta hear how the violins breathe. The fact that anyone’s even trying is kind of amazing

i bet the FDA just makes up tests as they go lol like why dont they just use a magic wand or something 🤡 and why do i keep getting the wrong cream from the pharmacy every time??

i just want my asthma meds to work without me feeling like i swallowed a battery

Honestly, I'm just glad someone's trying to fix this. I've seen friends struggle to afford their meds. If we can make these generics safe and affordable, it's worth the wait.